American collectors: OBAMA wants YOU !

Lately, wealthy art collectors have been saving millions of dollars by using the legendary A� 1031 exchange A�. The provision refers to a section in the American Internal Revenue Code that allows investors the opportunity to defer federal taxes indefinitely. Yet whilst the provision in the tax system is surging in popularity, the 2016 budget under the Obama administration foresees a considerable tax loss in need of rectifying.

1031 EXCHANGE : explained

Introduced in the 1920s, the 1031 exchange enabled farmers to sell property, livestock or equipment easily by deferring taxes. When selling property, farmers could avoid paying capital gains tax providing they used the proceeds to replace or upgrade their assets. Real estate agents quickly picked up on the small tax break, before it became a tax loophole favoured by art collectors and investors alike. Through this cherished 1031 exchange, investors have not seen their sectora��s hampered.

When buying an artwork, the A�1031 exchangeA� enables the investor to defer the capital gains tax payment indefinitely – 28% in the U.S. – as soon as you acquire a A�similarA� artwork.

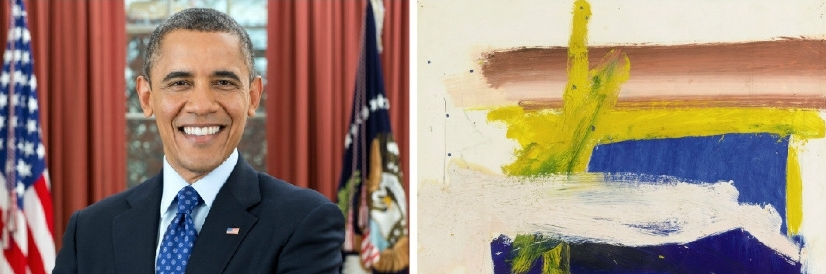

Imagine, for example, that you invested in a painting a few years ago and its recent sale provides you with a significant margin of one million dollars. The American treasury obliges you to pay $280,000 on the sale, but imagine that you then set eyes upon Willem de Kooninga��s Untitled (Blue Profundity) up for auction at Sothebya��s on May 12 (lot NA�34, estimate: $1.2 million to $1.8 million). If held for 10 years or more, and provided the economy is experiencing inflation, the value of the artwork itself would increase, the cost of this taxed profit portion gradually depleting.

Willem de Kooning, Untitled (Blue Profundity), 1958. Courtesy Sotheby’s.

The investor is exempt from paying fees up to a certain date, in the hope that inflation would clear the debt. The operation can be repeated over and over again.

For example, someone who made $10 million on the sale of a Warhol would ordinarily owe the government $2.8 million. But with the exchange, the entire $10 million can be recycled into the purchase of, say, a Gerhard Richter. If the investor holds that painting for a decade or longer before selling, inflation eats away at the effective cost of the $2.8 million bill.

A� If you are doing 5 transactions over 25 years, each time buying something more expensive, each time you dona��t pay the capital gain tax on the way. At the end of the day you are way ahead A� explain Josh Baer, Baer Faxt founder, and art advisor for Ebay to The New York Times. In situations where no capital gains taxes are collected because investors have died, heirs would usually face repayments.

The process is very similar to that of a no-interest loan from the government.

1031 EXCHANGE: the conditions

- All works must be acquired by investors, as part of a professional investment, not by collectors in a casual situation. There is consequently a growing number of companies holding artworks rather than individuals. However, Howard J. Levine, lawyer at Roberts & Holland LLP explained to The Wall Street Journal that investors are still able to exhibit works entering into the 1031 exchange framework within their own homes, A� perhaps not in your bedroom, but in a home office or public A�area where potential buyers or business acquaintances may come see it A� he explains.

- The new acquisition must be deemed similar to that which was sold. It is not recommended to sell a painting for a sculpture, it is advised to remain within the same medium.

- The two transactions must be carried out within a period of 180 days.

- The artworks must be in possession for at least a decade.

1031 EXCHANGE: under threat

A� Wea��ve definitely seen an uptick in the last two or three years A� admits Mary Cunningham, President of the Federation of Exchange Accommodators in The Wall Street Journal. It is for this reason that in Obamaa��s 2016 budget proposes to eliminate this fiscal loophole for artworks and other collectibles, conserving the 1031 exchange solely for real estate transactions. A� What we are seeing is yet another sophisticated federal tax avoidance scheme. Some people are exploiting this tax provision as an estate planning tool to help them transfer wealth A� Senator Ron Wyden of Oregon, Democrat, told The New York Times.

Suzanne Goldstein Baker, former president of the Federation of Exchange Accommodators, was often questioned on the subject, fervently maintaining that A� you have a lot of people who are upstream and downstream who are ordinary working people A� claiming that all that counts is a dynamic marketplace. (The New York Times)

1031 EXCHANGE: consequences of its elimination

The Obama administration hopes to accrue $19.5 million over the next ten years with this modification of legislation, however senior federal officials are so far unable to define the exact gain for the treasury. Others however cannot quite understand why art should be under the scrutiny of the government over real estate.

A study undertaken by Ernst & Young warns against this change, which, they suggest, would incite an annual diminution of the GDP by $8 billion.

But ultimately, eliminating the 1031 exchange would be a downward spiral. The current expansion of the market is accompanied by a simultaneous formalization of the art market, which includes the fiscal optimisation that comes with any asset class. It must be noted that the art market is the 4th largest global assets market (just behind the Foreign exchange market, Futures Options and Equity) with a��52 million exchanged in 2014.

With all the money that there is washing around in the art market, the issue is not a simple one to resolve, and whilst the government wants to cash in on its fair share, we can be sure that those against these tax reforms wona��t go down without a fight.